This is the final blog in our three-part series on the tactics insurance adjusters use to challenge insurance claims.

Winning a fair settlement after a car accident can feel like running a marathon uphill against the wind. Insurance companies employ a variety of tactics designed to minimize payouts, often leaving accident victims feeling confused, frustrated, and unsure of their rights.

This blog post concludes our three-part series that equips you with the knowledge to navigate the complexities of the insurance claims process. In Part 1 and Part 2, we explored how adjusters might delay claims with excessive paperwork demands, manipulate confusing policy language, and exploit technicalities.

This final installment focuses on three additional tactics insurance companies may use to weaken your claim:

- Lowball Offers: We’ll discuss how to recognize and counter these lowball settlement offers that significantly undervalue your claim.

- Shifting Blame: We’ll explore strategies to defend yourself against attempts by the insurance company to place fault on you, even partially.

- Invalidating Your Evidence: Discover how to gather and present strong evidence to counter attempts by the insurance company to undermine the legitimacy of your claim.

By understanding these tactics and the effective countermeasures available, you can protect your rights and maximize your car accident claim compensation.

1. The Lowball Offer: Testing Your Desperation

One of the most crushing experiences for accident victims after a wreck is receiving a settlement offer that is far less than what it should be. These lowball offers are used by insurance adjusters with the aim of quickly settling claims for the lowest possible amount. It preys on the injured party’s potential financial hardship and lack of knowledge about the true value of their claim. Understanding this tactic and how to respond to it is crucial for those injured in auto accidents.

Why the Lowball Offer Works

The strategy of presenting a lowball offer is rooted in several psychological pressures that accident victims may face:

- Financial Strain: After being injured in an accident, mounting medical bills and often an inability to work can lead to financial hardships that make any offer of settlement seem tempting.

- Desire for Closure: The drawn out stress of the claims process can instill a strong desire in accident victims to get the matter over with quickly, potentially leading them to accept a lower offer than they deserve.

- Uncertainty: Uncertainty about the outcome of the claims process or potential lawsuits can make a guaranteed, but lower, settlement seem like a good idea.

Strategies to Counter Lowball Offers

- Know Your Claim’s Worth: Before entering into negotiations, thoroughly assess the value of your claim, taking into account all medical expenses, lost wages, future treatments, and non-economic damages such as pain and suffering. This knowledge forms a solid basis for your negotiation stance.

- Do Not Rush to Accept: Resist the pressure to accept the first offer. It’s standard practice for the first offer to be a starting point for negotiations rather than a final settlement. Politely decline the offer and prepare a counteroffer based on the actual value of your claim.

- Provide Supporting Documentation: Strengthen your position by providing comprehensive documentation of your injuries, treatments, and other damages. Detailed evidence makes it harder for the insurance company to justify their lowball offer.

- Enlist Professional Help: Consider hiring a Fort Lauderdale car accident attorney to advocate for a fair settlement. An experienced attorney understands how to counter lowball offers effectively and can navigate the complexities of the insurance claims process on your behalf.

- Communicate Readiness to Go to Court: While filing a lawsuit may not be the desired outcome, showing that you are ready to take the matter to court if necessary can demonstrate your seriousness about getting fair compensation. Often, the possibility of litigation will motivate insurers to offer a more reasonable settlement.

The Role of Legal Representation

Having an attorney represent you can significantly change the tone of the negotiation process. Insurers are less likely to present lowball offers to accident victims who have legal representation, knowing that an experienced lawyer should easily refute such tactics.

Also, attorneys have the expertise to calculate the comprehensive value of a claim, ensuring that all factors, including future needs and non-economic damages, are considered in the settlement.

2. The Blame Game: Shifting Fault

A critical part of the insurance claims process is the determination of fault. Insurance companies, in their quest to minimize financial payouts, may engage in the “blame game,” a tactic aimed at shifting fault — or at least a portion of it — to the accident victim. This strategy not only complicates the claim process but can also significantly impact the compensation the injured party might receive. Understanding how fault is assessed and the ways to counter misplaced blame is essential for navigating this challenge effectively.

The Significance of Fault in Insurance Claims

Determining fault in car insurance claims is important because it directly affects how much compensation you can recover after a car accident. Florida is a modified comparative negligence state. This means that the amount of money you can recover in an accident claim can be reduced by the degree of fault you had in the accident. If you are found to be 10% responsible for the accident, your compensation will be reduced by 10%. If you are found to be more than 50% responsible, you will not be able to recover compensation.

Insurance Adjusters and Fault Attribution

Insurance adjusters may employ several tactics when attempting to shift fault to the injured party, including:

- Misinterpreting Evidence: Adjusters might selectively interpret accident reports, witness statements, or even the accident victim’s own account of the incident to suggest contributory negligence.

- Exaggerating Minor Details: Minor or irrelevant details from the accident may be exaggerated to question the injured party’s driving behavior or decision-making at the time of the incident.

- Overlooking Contributory Factors: Factors that might reduce the accident victim’s responsibility or highlight the other party’s fault could be downplayed or ignored.

Countering Fault Attribution Tactics

Overcoming these blame-shifting tactics requires a combination of evidence gathering, strategic communication, and legal insight:

- Gather Comprehensive Evidence: From the outset, compile as much evidence as possible, including photos of the accident scene, police reports, witness statements, and any relevant traffic or surveillance camera footage. This evidence can provide a factual basis to dispute skewed interpretations of the incident.

- Maintain Consistent Communication: Be mindful of how you describe the accident, both in initial reports and in all other communications with the insurance company. Consistent, accurate accounts can prevent misunderstandings that might be exploited to shift blame.

- Utilize Expert Testimony: In complex cases, expert testimony from accident reconstruction specialists or traffic engineers can clarify the details of the accident, providing authoritative evidence to support your account of fault.

- Seek Legal Representation: A skilled attorney can be instrumental in challenging attempts to unfairly assign blame. Legal professionals know how to analyze evidence, counter biased interpretations, and ensure that fault is assigned based on a balanced consideration of all facts.

The Role of Legal Representation in Fault Disputes

The involvement of a legal representative serves multiple functions in disputes over fault. Lawyers are not only equipped to challenge and negotiate with insurance adjusters but can also represent accident victims in mediations or court proceedings if disputes over fault cannot be resolved amicably. Their expertise in the nuances of personal injury and traffic law is crucial in presenting a compelling case for the accurate attribution of fault.

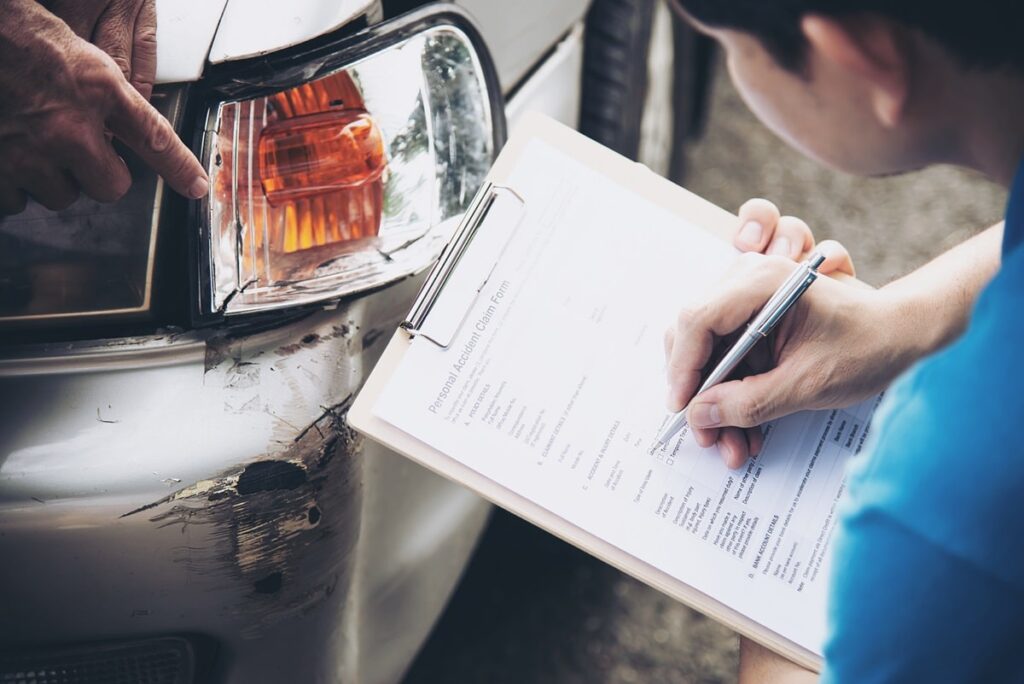

3. Invalidating Your Evidence: The Battle Over Documentation

Insurance companies may attempt to invalidate the evidence presented by accident victims. This tactic targets the documentation that supports the claim’s legitimacy and value, including medical records, proof of income loss, and evidence of property damage. Successfully navigating this aspect of the claims process requires a strategic approach to evidence collection and presentation, ensuring that all documentation is bulletproof against attempts to undermine it.

Tactics Used to Invalidate Evidence

Insurance adjusters might employ various strategies to challenge the validity of the injured party’s evidence, such as:

- Questioning Medical Treatment: Adjusters may dispute the necessity or duration of medical treatment by suggesting it was excessive or unrelated to the accident. They might also challenge the credibility of medical providers or the accuracy of medical reports.

- Disputing the Extent of Damage: In cases of property damage, insurers may argue that the damage was pre-existing or not as severe as claimed. They might also contest the estimated repair costs, suggesting they are inflated.

- Undermining Evidence of Lost Wages: For claims involving compensation for lost income, adjusters might question the documentation supporting the injured party’s reported earnings or their inability to work due to injuries sustained in the accident.

Countermeasures to Protect Your Evidence

- Ensure Comprehensive and Accurate Documentation: Collect and organize all relevant documentation from the outset, ensuring it is complete, accurate, and properly authenticated. This includes detailed medical records that link treatments directly to the accident and clear records of expenses and lost wages.

- Obtain Expert Opinions: In cases where the insurance company disputes the validity of certain evidence, securing expert opinions can be pivotal. For example, an independent medical examination by a specialist can corroborate the necessity and scope of medical treatments, while a professional appraisal can validate claims of property damage.

- Utilize Legal Representation: An experienced attorney can play a crucial role in safeguarding the integrity of your evidence, assembling and presenting evidence in a manner that preempts and counters attempts at invalidation. They can also facilitate the acquisition of expert testimonies and ensure that all documentation meets the stringent standards required for legal and insurance proceedings.

- Maintain a Proactive Stance: Anticipate potential challenges to your evidence and prepare accordingly. This includes having clear reasons for all treatments and repairs, as well as maintaining a timeline of events and documentation that demonstrates the direct impact of the accident.

Secure Your Rights and Maximize Your Car Accident Claim

Navigating the insurance claims process can feel like an uphill battle, full of obstacles designed to minimize your compensation, especially in a no-fault state like Florida. An attorney can ensure your rights are protected, help you determine if your injuries qualify for a lawsuit beyond PIP coverage, and fight to get the maximum compensation you deserve.

Fort Lauderdale car accident attorney Lisa Levine has been protecting the rights of those seriously injured by negligence for more than 35 years. If you’re ready to get the compensation you deserve, Lisa is here to guide you through every step of the process. Your recovery and your rights are too important to leave to chance. Call (954) 256-1820 today to schedule a free consultation and get the help you deserve.